Aakhya Weekly: The Budget Special

Navigating the Future – Brief Insights into Budget 2024-25

By Aakhya India Policy Team

Access Aakhya India’s Union Budget 2024 Report here, for a detailed budget analysis.

Finance Minister Nirmala Sitharaman has unveiled the first budget for the Narendra Modi-led government's third term, underscoring a commitment to continuity in the administration’s priorities. This budget reflects a strategic continuation of prior priorities, emphasising several key themes over a five-year horizon. It allocates substantial funds to promote innovation, research, and development, and to create learning and employment opportunities, especially for the youth. New credit mechanisms and improved capital access are introduced to support MSMEs and farming communities. Additionally, the budget strongly emphasises urban and rural infrastructure development, alongside investments in energy transition, to drive sustainable economic growth.

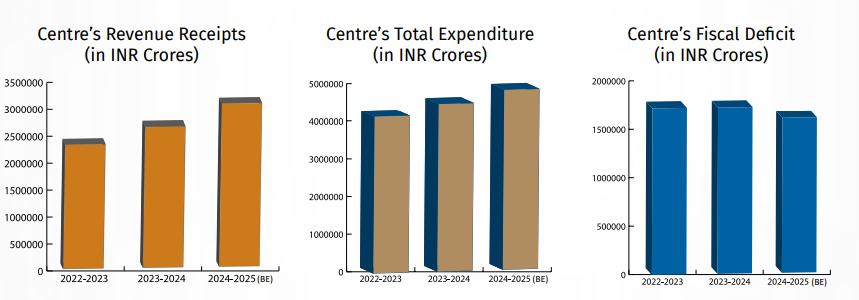

For the fiscal year 2024-25, the budget projects total receipts, excluding borrowings, at ₹32.07 lakh crore, with total expenditure estimated at ₹48.21 lakh crore. Net tax receipts are anticipated to be ₹25.83 lakh crore, and the fiscal deficit is 4.9% of GDP. Reaffirming the success of the fiscal consolidation strategy initiated in 2021, the Finance Minister has set a target to reduce the deficit to below 4.5% of GDP in the coming year, with a long-term goal of a declining Central Government debt-to-GDP ratio from 2026-27 onwards.

Aligned with the government's 'Viksit Bharat' vision, the budget identifies nine key priorities as outlined in the interim budget speech: Productivity and Resilience in Agriculture, Employment & Skilling, Inclusive Human Resource Development and Social Justice, Manufacturing & Services, Urban Development, Energy Security, Infrastructure, Innovation, Research & Development, and Next Generation Reforms.

9 Priorities Paving the Road to Viksit Bharat

Productivity and Resilience in Agriculture

The 2024-25 budget shows that the government wishes to conduct a comprehensive review of the agriculture research setup, in a bid to identify gaps and revamp obsolete mechanisms. It is intended to enhance productivity, develop large-scale vegetable production clusters, improve self-sufficiency in pulses and oilseeds, and develop climate-resilient varieties, with ample access to funds even for the private sector. In addition, one crore farmers will be initiated into natural farming, supported by certification and branding, and the establishment of bio-input resource centres. Other proposals include- Digital Public Infrastructure for agriculture, and a National Cooperation Policy to boost the cooperative sector and rural economy.

Employment & Skilling

The 2024-25 budget offers continuity from the previous years, prioritising the aspirations of young India through the Prime Minister’s ‘Package of 5’ schemes, facilitating learning and employment opportunities for millions of youth. These include 3 Employment Linked Incentive (ELI) schemes, a scheme for training students and upgrading training institutes, a model loan scheme for skilling, etc. The ELI schemes cover provisions such as DBTs, incentives to employers in manufacturing, and reimbursements for additional hires. The budget also includes a scheme for increasing women's workforce participation and boosting women's SHG enterprises through skilling, market access, and other initiatives.

Inclusive Human Resource Development and Social Justice

The budget aims to empower all eligible people through comprehensive education, health programs, and economic activities for craftsmen, artisans, self-help groups, and entrepreneurs through schemes like PM Vishwakarma and PM SVANidhi. Similarly, the Purvodaya plan’s infrastructure, irrigation, and industrial projects will drive the development of backward regions across eastern and northeastern states. Other focus areas include building 3 crore additional houses under PM Awas Yojana, allocation of over ₹3 lakh crore for women-led development, PM Janjatiya Unnat Gram Abhiyan benefiting 5 crore tribal people, and the setting up of 100+ branches of India Post Payment Bank in the North East region.

Manufacturing & Services

The budget emphasises MSMEs and labour-intensive manufacturing with a comprehensive package including financing, credit guarantees, regulatory changes, and technology support. The government is adopting a holistic approach by reforming key aspects across industries, given the emphasis on new investment-ready industrial parks, rental housing for workers' welfare, shipping industry reforms, a Critical Mineral Mission, and offshore mining auctions. Furthermore, the government plans to improve service sector productivity by developing Digital Public Infrastructure and an Integrated Technology Platform for IBC.

Urban Development

Given the growing demand for urban modernisation, the budget plans for several initiatives, including a collaborative Centre-States program to develop 'Cities as Growth Hubs' through economic and transit planning, and orderly development of peri-urban areas. Furthermore, it emphasises policy support and market-based mechanisms for creative brownfield redevelopment, formulation of Transit Oriented Development plans for 14 large cities and a ₹10 lakh crore investment towards PM Awas Yojana Urban 2.0 to address housing needs for 1 crore urban poor and middle-class families. Support will also be extended to promoting policies for efficient rental housing, water supply, sewage treatment, and solid waste management projects in 100 large cities.

Energy Security

The budget outlines the government’s strategy for sustaining high and resource-efficient economic growth while ensuring energy security. It mentions plans to introduce a roadmap with incentives for industries to move from energy efficiency to emission targets. Similarly, it will introduce a policy document on energy transition pathways that will balance employment, growth, and environmental sustainability. Announced during the interim budget of 2024-25, the PM Surya Ghar Muft Bijli Yojana for rooftop solar installations has seen remarkable uptake, and a pumped storage policy will support electricity storage. In addition, the government will explore partnerships with the private sector to advance small and modular nuclear reactors and alternate fuels and set up Advanced Ultra Super Critical Thermal Power Plants.

Infrastructure

In continuation of this year’s interim budget, the Central Government will maintain strong fiscal support for infrastructure, with ₹11.11 lakh crore allocated for capital expenditure, around 3.4% of GDP. States are also encouraged to support investments in infrastructure with long-term interest-free loans totalling ₹1.5 lakh crore. In addition, private investment will be promoted through suitable policies and viability gap funding. Phase IV of PMGSY will enhance rural connectivity, and substantial funds will support flood mitigation and irrigation projects in Bihar, Assam, Himachal Pradesh, Uttarakhand, and Sikkim.

Innovation, Research & Development

In a strategic push to drive forward the nation's innovation and research capabilities, the government has outlined a comprehensive plan, including the implementation of the Anusandhan National Research Fund. This will serve as a cornerstone for advancing basic research and development of prototypes, and cutting-edge scientific breakthroughs. A robust mechanism will also be introduced to catalyse private sector-driven research and innovation on a commercial scale. Furthermore, a dedicated venture capital fund will be established to expand the space economy by 5 times over the next decade, in alignment with long-term economic goals.

Next Generation Reforms

The government announced the establishment of an Economic Policy Framework to drive employment opportunities and sustained growth, focusing on land, labour, capital, entrepreneurship, and technology reforms. Key initiatives include land digitisation, integration of labour services with the e-shram portal, and a financial sector strategy. In addition, climate finance taxonomy and Variable Capital Company structures will be introduced, and FDI rules are expected to be simplified. In terms of fiscal prudence, the government proposed a fiscal deficit target of 4.9% of GDP for 2024-25, aiming for below 4.5% next year.

Taxation

The Budget for 2024-25 builds on the previous year's reforms by further simplifying direct taxes, coupled with the intent to enhance compliance. Finance Minister Nirmala Sitharaman has initiated a comprehensive review of the Income Tax Act, 1961, to streamline the tax system. The government intends to encourage more taxpayers to adopt the new Income-Tax regime, and to achieve this, the standard deduction was increased, and tax slabs with revised rates were introduced, providing more post-tax income for salaried individuals. In addition, pensioners will benefit from a marginal increase of ₹10,000 in the deduction allowed on family pensions.

FM Sitharaman highlighted the success of the GST regime and ongoing efforts to streamline tax structures and expand coverage. To boost domestic manufacturing, export competitiveness, and advancements in critical sectors,

Basic Customs Duty (BCD) on various goods has been adjusted or reduced drastically.

Customs duties on three cancer medicines and various critical minerals are fully exempted.

BCD on mobile phones, certain marine products, and textiles has been reduced, while duties on ammonium nitrate and PVC flex banners have been increased due to health concerns.

The budget increased the tax on long-term and short-term capital gains from 10% to 12.5%, and 15% to 20% respectively. Additionally, tax rates on futures and options transactions were sharply hiked, and new regulations for income from share buybacks were introduced. These measures temporarily dampened market sentiment, as taxpayers expressed disappointment over the spiked LTCG & STCG tax rates. However, the proposal to abolish the Angel Tax, a controversial levy on funds raised by startups, was received warmly by the startup industry.

Compulsions of Coalition Politics

After the 2024 General Elections, the BJP formed a coalition government with substantial support from pre-poll allies like the Telugu Desam Party (TDP) and the Janata Dal-United (JDU). The BJP’s underwhelming performance in crucial states such as Uttar Pradesh, Maharashtra, and West Bengal, led to a dramatic reduction of its seats in parliament, falling below the majority mark for the first time since 2014. The fall from 303 seats in 2019 to 240 seats in 2024 limits the BJP’s show of strength, understandably heightening their dependence on regional partners for administrative stability. Consequently, allies like the TDP and JDU are expected to influence the political discourse and shape the policy priorities throughout the NDA’s third term.

The 2024-25 budget reflects the BJP’s coalition compulsions, given how significant allocations were announced for Andhra Pradesh, addressing long-standing demands of the state’s constituents since the bifurcation and the coming into effect of the Andhra Pradesh Reorganization Act of 2014. The Modi Government has approved ₹15,000 crores for Amaravati’s development for this year alone, including prioritised funding for the delayed Polavaram Irrigation Project. A significant portion of the budget has also been earmarked for major infrastructure and tourism investments in the eastern states of Bihar and Odisha. Bihar’s JDU is a crucial ally for the NDA and a focus status for the BJP’s political strategy due to upcoming state elections. For instance, FM Sitharaman announced ₹26,000 crore for several projects, including the Patna-Purnea expressway. These allocations demonstrate the BJP’s coalition-appeasement strategy, as it attempts to run a stable government while striking a balance between regional demands and national priorities.

Concluding Remarks

The 2024-25 Budget exemplifies the Modi government's strategic focus on sustainable growth, tax simplification, and regional equity. By advancing direct and indirect tax reforms, increasing capital expenditure, and prioritising infrastructure and innovation, the budget aligns with the 'Viksit Bharat' -vision. Enhanced support for MSMEs, farmers, and backward regions reflects a commitment to inclusive development. Notably, the budget speech conspicuously omits mention of the Indian Railways, historically the nation's largest employer, signalling a potential shift in approach, as it offers the government flexibility to strategise its capital expenditure. In addition, the coalition dynamics of NDA 3.0 are evident in the budget, given the targeted allocations for Bihar and Andhra Pradesh, While this may have caused disappointment among opposition-ruled states, the BJP deems it necessary to achieve administrative stability in its third consecutive term.

Access Aakhya India’s Union Budget 2024 Report from our website link below, for a detailed budget analysis.