The Aakhya Weekly #143 | India’s Startup Dream Needs a Reset

In Focus: India’s Startup Moment Is Here. But What’s Missing?

by Yashvika Malhan

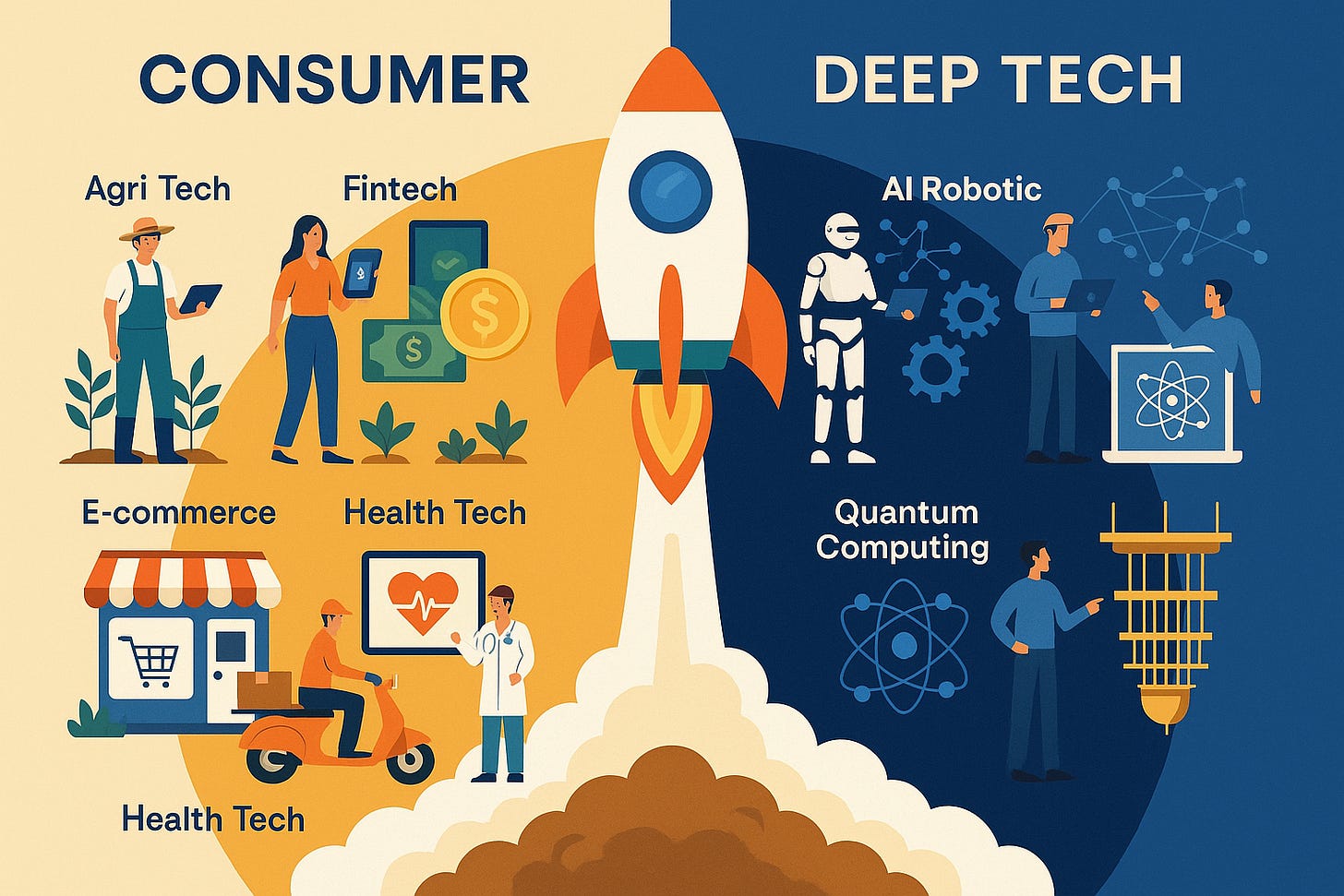

For the past two weeks, India’s policy and business corridors have been abuzz over the remarks made by Union Minister of Commerce Piyush Goyal at the Startup Mahakumbh. His provocative question — "Are we going to be happy being delivery boys and girls? Fancy ice creams and cookies... is that the destiny of India?" — ignited a firestorm of reactions within the country’s startup ecosystem, sparking a larger debate about the future of innovation in India.

Minister’s comparison between India and China’s startup ecosystems stirred both support and criticism, with founders, venture capitalists, commentators, and policymakers all offering their perspectives. Some supported the minister’s call for more deep-tech innovation, while others were quick to defend the merit of consumer startups, citing jobs, impact, and scale. What’s emerged is not just a backlash over a comment, but a broader discussion on India’s vision for startups, the Startup India scheme, and the elusive goal of innovation-led growth.

Startup India: Ten Years In

In 2016, the Startup India (SUI) initiative was launched with a bold promise: to make India the world’s startup capital. Nearly a decade later, the numbers certainly paint a rosy picture. India is now home to over 1.59 lakh recognised startups, up from just 428 in 2016, making it the third-largest startup ecosystem globally. These startups span 56 sectors — from agriculture and health tech to clean energy and education. And as of 2024, India boasts 113 unicorns with a combined valuation of $350 billion.

Behind the scenes, the government’s financial enablers through SUI — the Fund of Funds for Startups (FFS), the Startup India Seed Fund Scheme (SISFS), and the Credit Guarantee Scheme for Startups (CGSS) — have pumped critical capital into the ecosystem. At the state level, specific policies have also been tailored to nurture this boom, further cementing the country’s startup credentials.

However, as Minister Goyal himself noted, "Should we be obsessed with numbers?" Metrics do show expansion, but do they reveal innovation depth or true value creation?

Because while the ecosystem is growing, there’s still a long road ahead in terms of quality. Access to funding remains starkly uneven, especially for high-risk ventures like deep-tech startups. Regulatory compliance continues to be a maze, despite the government’s efforts to streamline the process. Talent retention remains an uphill battle, and startups have limited engagement with public procurement platforms like GeM (Government e-Marketplace).

Fragmentation remains a persistent challenge. With 42 ministries overseeing different aspects of the startup ecosystem, coordination issues often lead to implementation delays—something the Parliament Standing Committee has also pointed out. And if you look at the data, there’s more bad news: a 2023 report found that 56% of India’s unicorns are domiciled outside the country, a worrying trend that points to the challenges in creating a truly supportive environment for homegrown businesses.

On paper, the reforms have been impressive: the angel tax has been abolished, capacity-building initiatives through SIU portals such as BHASKAR and MAARG have been launched, and patent approvals have been faster. But on the ground, the reality is less glamorous. The much-touted "single window clearance" system remains a tangled web of bureaucracy, often leaving founders frustrated.

So, while Startup India has certainly put India on the global map, the question remains: is the initiative truly fostering innovation, or is it simply inflating numbers that, in the long run, may not tell the whole story?

Innovation Takes a Back Seat

Minister Goyal’s remarks, while jarring to some, were not entirely misplaced. India’s ambition to become a tech-first, innovation-driven economy is essential in a world increasingly defined by artificial intelligence, biotechnology, quantum computing, and green energy. The statement reflected a desire to push the ecosystem beyond low-tech consumer services toward globally competitive tech solutions.

And indeed, culturally, we’ve long struggled with embracing high-risk, high-reward innovation. From a young age, we're taught to minimise failure, favour job security, and follow predictable paths. Even with a massive base of STEM talent with over 2.25 million graduates, India’s contribution to core research and product innovation continues to lag. We spend just 0.7% of our GDP on R&D, starkly contrasting with China’s 2.4% and the US’s 3.5%. That funding gap continues to hold India back.

More concerning is the imbalance in venture capital deployment. A report from Inc42 highlights how the top 10 sectors, such as e-commerce, fintech, and enterprise tech, account for 95% of the funding and 91% of the deals. Meanwhile, emerging sectors like AI and deeptech struggle to capture attention and capital. For instance, AI startups in India, despite the emergence of 338 new ventures, have raised only $640 million since 2019. Social impact startups face their own challenges. Many operate in rural markets and are deemed unscalable or uninvestable by traditional VC standards. In effect, important sectors get boxed out.

What’s Holding Us Back?

‘Innovation does not happen in a vacuum.’ It requires a robust ecosystem that offers patient capital, state-of-the-art research infrastructure, a willingness to take early-stage risks, and a regulatory environment that encourages experimentation.

India’s absence on the global tech stage reflects deeper gaps—an education system misaligned with innovation, underleveraged research bodies like DRDO and CSIR, and weak industry-academia ties. The newly launched Anusandhan National Research Foundation is a step in the right direction, but its long-term impact remains to be seen.

Moreover, India’s inability to foster structured collaboration between corporates and startups only deepens the gap. In contrast to countries like South Korea or China, where large corporations actively drive startup growth, India lacks formal B2B pipelines and co-development platforms.

That said, the value of consumer startups cannot be overlooked. In fact, industry leaders were quick to defend the contributions of consumer platforms, even in seemingly niche sectors like ice cream and cookies, as they generate jobs, serve evolving urban markets, and build supply chains. The question isn’t whether these startups are valuable — they are. The question is whether the ecosystem, as a whole, is future-ready.

Beyond binaries, Toward balance

India’s startup story isn’t a battle between deep-tech and D2C. Dessert brands and delivery apps create value just as meaningfully as climate tech labs and AI ventures shape the future. Different sectors serve different purposes, and both must be supported appropriately.

What’s needed now is not a new scheme but a sharper, more responsive approach to the one we already have. Startup India has laid the groundwork since its launch, providing recognition, basic support, and early momentum. But its next phase must do more than sustain; it must enable. That begins with better feedback and assessment. A structured, periodic gap analysis, which is grounded in real-time inputs from founders, investors, and ecosystem partners, can help address operational blind spots and execution delays. Impact assessment should not be an afterthought; it should shape the next phase of this ambitious initiative.

This doesn’t mean support should be spread thin; rather, it needs to be more targeted. But that targeting should be thoughtful, not based on headlines or hype. We’re not saying we should eliminate targets altogether. The point is to make sure support is going where it’s actually needed, whether that’s early-stage startups, underfunded sectors, or overlooked regions. Funding requires moving from grants to co-investment models that partner with VCs, especially, though not limited to, early-stage and deep-tech ventures. It also requires creating long-term capital pathways that match the life cycles of innovation and not just quarterly metrics.

We also need to remove the friction from the system. Regulatory complexity, opaque compliance norms, and paperwork-heavy processes must go. While metro cities still dominate the startup map, talent is everywhere. Tier 2 and Tier 3 cities have ideas, ambition, and drive, but they need infrastructure, mentorship, and access to markets. Regional hubs could change that if we invest in them meaningfully.

Ultimately, it’s not about who’s doing more—the government or the private sector. It’s about what more can be done together. Startup India 1.0 got us moving. Now we need to go deeper, build smarter, and support innovation that is inclusive, ambitious, and built to last.

It’s not either-or. It’s both.

Top Stories of the Week

Supreme Court Pushes for Clear Food Labels Amid Rising Health Concerns

On April 9, 2025, the Supreme Court directed the Food Safety and Standards Authority of India (FSSAI) to finalise its report on Front-of-Pack Warning Labels (FOPL) within three months, setting a deadline of July 9, 2025. This directive follows a Public Interest Litigation (PIL) filed by 3S and Our Health Society in August 2024, urging the implementation of FOPL on packaged foods high in sugar, salt, and saturated fats. The petition highlighted the alarming rise in non-communicable diseases (NCDs), such as diabetes and heart disease, which account for 6 million deaths annually in India. FOPL is deemed crucial as it enables consumers to make informed decisions about their food choices, particularly regarding harmful ingredients.

In response, FSSAI submitted an affidavit outlining the authority's efforts to implement the Indian Nutrition Rating (INR) system—a star-based front-of-pack labelling system balancing both harmful and beneficial nutrients.After receiving over 14,000 stakeholder comments on the 2022 draft regulation, FSSAI formed an Expert Committee in 2023 to review the feedback. The committee’s final report, which will be submitted for approval, is expected to be closely monitored by industry stakeholders.

Telangana first Indian state to implement SC sub-categorisation

Telangana has become the first state in India to implement SC sub-categorisation through the Telangana SC (Rationalisation of Reservations) Act 2025, dividing SCs into three groups to ensure quota benefits reach the most marginalised. This move follows a Supreme Court judgment that upheld the constitutionality of sub-classifying SCs and STs for separate quotas.

The sub-categorisation divides 59 SC sub-castes into three groups: Group I with 1% reservation for 15 most backward sub-castes, Group II with 9% for 18 sub-castes with marginal benefits, and Group III with 5% for 26 relatively better-placed sub-castes. This aims to address historical inequities and prevent the monopolisation of reservation benefits by certain groups. While 33 sub-castes remain in their previous groups, 26 have been shuffled, affecting 3.43% of the SC population.

This classification has been notified under the Telangana State Commission for Backward Classes Act, 1993, and seeks to address internal inequities among SCs in access to education, employment, and welfare schemes. The government intends to further enhance reservations for SC based on data from the Census 2026.

A Few Good Reads

PShabana Mitra, Cledwyn Fernandez & Anjhana Ramesh write about why women are missing from the factory floors in India

Sreeram Chaulia explains the ideological battle between the Trump administration and academic institutions

Ashish Singh argues that defence diplomacy is now a strategic pillar of India’s foreign policy ambitions

Soumyabrata Mondal observes that despite years of implementing targeted poverty alleviation programs, India continues to struggle with deep-rooted socio-economic disparities.

Dr. Aruna Sharma states that supportive tax policies can position India as a global beverage export hub, boosting economic growth and employment.