The Aakhya Weekly #33 | The Budget Special

In Focus: Where we are; where we are headed

This budget comes at a crucial juncture. The past couple of years have been punctuated by a series of shocks, prompted by the COVID pandemic, the Russia-Ukraine war, rate hikes by the US Fed and the slowdown of the Chinese economy. Commodity prices have shot up, inflation is climbing, and capital is flowing out of emerging economies. Global growth, in a nutshell, is slowing.

Despite these headwinds, the Indian economy has shown robust growth. India’s GDP growth in the current Fiscal is forecasted to be around 6.5-7% - making it the world’s fastest growing major economy. As per the Economic Survey for the year 2022-23, this growth is likely to continue in the medium term.

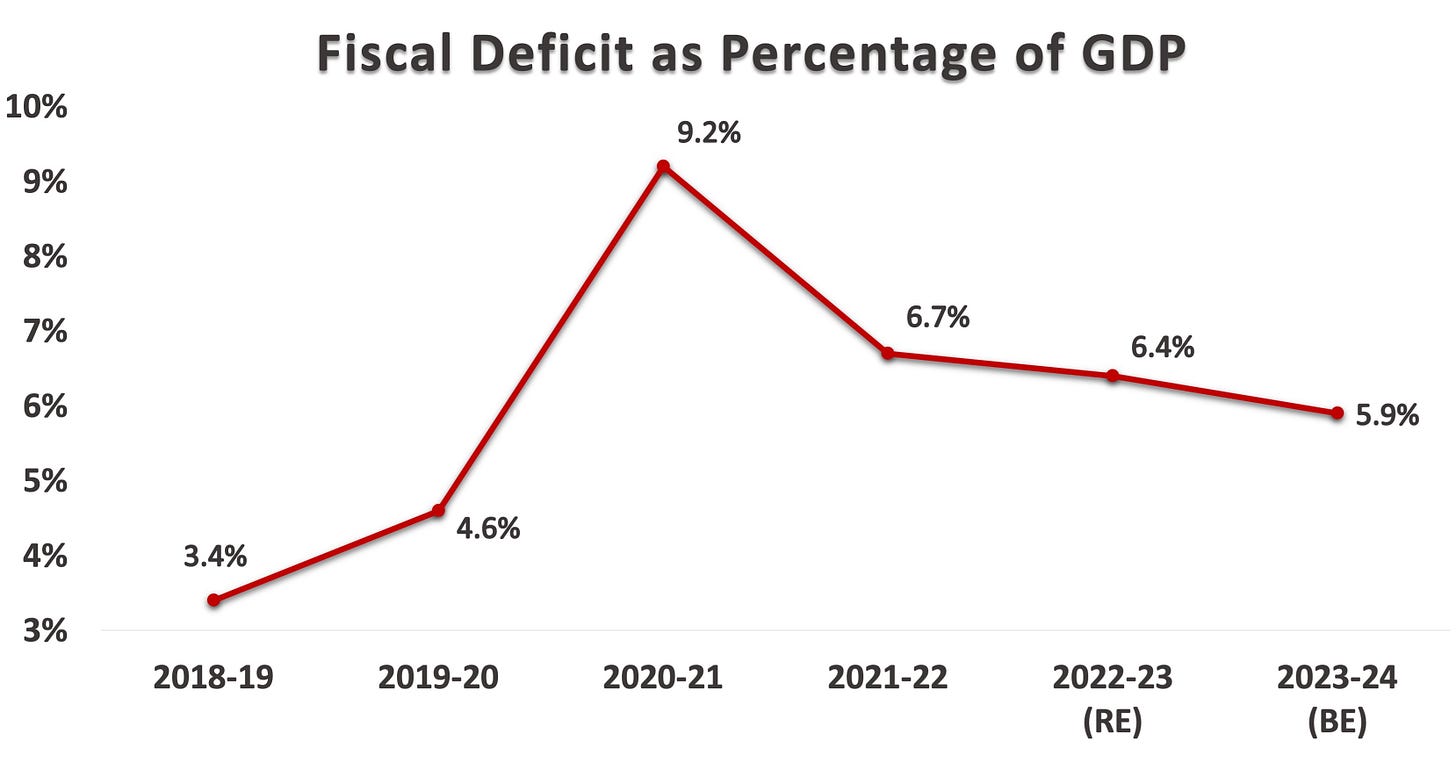

This past year presented many fiscal pressures – with global prices of fuel, food, fertilisers and more sky-rocketing. Despite this, India is gradually bringing down its fiscal deficit, from 9.2% of the GDP in Fiscal 2021 to an expected 6.4% in Fiscal 2023. Government revenues showed healthy growth. While expenditures increased, they were re-oriented towards capital expenditure – which showed a year-on-year growth of over 60% in the period between April and November, 2022. State governments, too, improved their finances.

This year also saw high rates of inflation across the world. The Russia-Ukraine war disrupted crucial supply chains, which, paired with profligate spending by many economies during the pandemic, led to prices soaring globally. Prices in India, too, were high – fuel costs soared, edible oil imports tightened, harvests were poor – leading to consumer inflation in excess of RBI’s tolerance limit of 6% for much of the year. Even so, with the RBI sopping up surplus liquidity, along with government measures and a drop in global crude prices, inflation declined to under 6% by the end of the year. In much of the developed world, in contrast, inflation remains close to double digits.

These are, however, silver linings in dark clouds. The global economy is widely expected to go into recession in the coming year. India is not immune to these pressures.

Preparing this budget, Smt. Nirmala Sitharaman would have been in a delicate bind. On the one hand, this was her last complete budget before the 2024 Lok Sabha elections, creating a pressure for sweeping (and expensive) populist measures. On the other hand, with a precarious global economy looming, there was little room for complacency, and much wisdom in remaining prudent.

This budget chooses prudence. Flashy, populist fireworks have been resisted in favour of drab but necessary fiscal consolidation. Spending has been concentrated on building infrastructure, which went up by 37% in absolute terms. Recurring expenditures have been controlled, and subsidies have been slashed.

In a year of difficult choices, this is an astute choice to make.

Here are our top three takeaways from this budget:

Massive push on infrastructure: Animated by the belief that capital investments spur growth, this budget makes a strong push for infrastructure. For the third year in a row, capital investment outlays have been increased - this time by a whopping 33%. India has budgeted for capital expenditure of INR 10 lakh crore this year. Railways and roads will get a massive boost. INR 75,000 crore shall be pumped into a hundred critical transport infrastructure projects. States will be incentivised to adopt capital expenditure-oriented policies as well. The Government is not merely relying on its own finances either; a new Infrastructure Finance Secretariat will also mobilise private investment in infrastructure.

Big nudges for the new tax regime: In 2020, Smt. Sitharaman had introduced a simplified income tax regime. While the prevailing regime allowed for exemptions and deductions, one could forego these and move to the lower tax rates the new regime offered. The much-lauded income tax changes proposed in this budget all attempt to increase the attractiveness of this new regime. The new regime shall now be the default, with taxpayers having the option to opt out. The number of tax brackets have been cut from six to five, and tax rates have been slashed across the board. The income ceiling to receive a rebate has been pushed to INR 7 lakhs, from INR 5 lakhs. Several other changes have also been brought in, each specifically applicable to the new regime. With these changes, Smt. Sitharaman projected, the Government shall forego INR 37,000 crore in direct tax revenue.

The digitalisation of everything continues: One of the key projects of the current Government has been to bring efficiency in service delivery through digitalisation. The project shall continue this year. The Government shall introduce a one-stop solution for people to reconcile and update their identity and address for a variety of Government purposes, removing existing redundancies. Businesses shall be given a common PAN-based identifier for a variety of processes. The scope of Digilocker shall be extended, and a separate ‘Entity Digilocker’ shall allow businesses and charities to store and share documents securely. Novel digital solutions are also being introduced for a variety of other purposes - ranging from agriculture, to skilling, to education.

Smt. Sitharaman’s budget speech is available here. This year’s Finance Bill is available here. The actual budget - the annual financial statement - is available here. The Economic Survey for the year 2022-23 is available here.

Here’s what else you need to know

Taxation

Basic Customs Duty (BCD) rates, on goods other than textiles and agriculture, have been reduced from 21% to 13%. This has necessitated minor changes in the basic customs duties, cesses and surcharges on some items including toys, bicycles, automobiles and naphtha.

To make the domestic fluoro-chemicals industry more competitive, Basic Customs Duty on acid-grade fluorspar is being reduced from 5% to 2.5% .

The National Calamity Contingent Duty (NCCD) on specified cigarettes will be revised upwards by about 16%.

To curb circumvention of duty, Basic Customs Duty rate on compounded rubber will be increased from 10% to 25% or INR 30/kg, whichever is lower, at par with that on natural rubber other than latex.

Labour and Skilling

To improve India’s skilling ecosystem, the ‘Pradhan Mantri Kaushal Vikas Yojana 4.0’ shall be launched, emphasising on-job training, industry partnership and alignment of courses with the needs of the industry. Future-oriented courses shall also be introduced under its ambit, including coding, AI, robotics, mechatronics, IOT, 3D printing, drones and more. Further, 30 ‘Skill India International Centres’ shall be set up to upskill people for international opportunities.

To improve the digital ecosystem for skilling, the Government shall launch a unified Skill India Digital Platform. This shall allow demand-based formal skilling, linking with employers and facilitating access to entrepreneurship schemes.

A pan-India apprenticeship promotion scheme shall be rolled out to provide stipend support to the youth.

Agriculture and FMCG

Huge fiscal outlay for the agriculture sector continues, albeit with a modest reduction of 3% in the total figure earmarked for Ministry of Agriculture and Farmers Welfare compared to last year. The total food subsidy to Rs. 1,97,350 crore, the fertilizer subsidy considerably increased to Rs. 1,75,148 crore, and the agriculture credit target increased to Rs. 20 lakh crore with focus on animal husbandry, dairy and fisheries.

Open source and inter operable digital public infrastructure for agriculture will be built to provide information services for crop planning and health, improved access to farm inputs, credit, and insurance, help for crop estimation, market intelligence, and support for growth of agri-tech industry and start-ups.

An agriculture accelerator fund will be set up to encourage agri-start ups. In addition, incentives will be rolled out to bring 1 crore farmers under the ambit of chemical-free natural farming. In lieu of the international year of millets, the Indian Institute of Millet Research, Hyderabad, will be upgraded as a centre of excellence.

Healthcare

The Government shall establish 157 nursing colleges, in co-location with the 157 medical colleges established since 2014.

The Government is initiating a mission to eliminate sickle cell anaemia by 2047. The mission shall entail awareness creation, counselling and universal screening for persons between 0-40 years in tribal areas.

To boost innovation, facilities in select ICMR labs shall be made available for research by academia and the private sector. Further, a new program to promote research and innovation for pharmaceuticals shall be taken up by centres of excellence. The private sector shall also be encouraged to invest in research and development in specific priority areas.

Technology, Media and Telecommunications

One hundred labs for developing applications using 5G services will be set up in engineering institutions to realise a new range of opportunities, business models, and employment potential.

Research and development grant will be provided to one of the IITs for five years to explore opportunities in lab-grown diamonds (LGDs), a technology-and innovation-driven emerging sector with high employment potential. These environment-friendly diamonds have (optically and chemically) the same properties as natural diamonds.

Banking, Finance and Insurance

A national financial information registry will be set up to serve as the central repository of financial information. A new legislative framework will be formulated in consultation with the RBI to govern the credit public infrastructure for the above

A slew of measures will be taken to improve GIFT (Gujarat International Finance Tech-City), such as a single window system for registration and approval from IFSCA, SEZ authorities, GSTN, RBI, SEBI and IRDAI (Insurance Regulatory and Development Authority), permit acquisition financing by IFSC Banking Units of foreign banks, and recognising offshore derivative instruments as valid contracts, among others.

SEBI will be empowered to develop, regulate, maintain and enforce norms and standards for education in the National Institute of Securities Markets and to recognize award of degrees, diplomas and certificates

Manufacturing

To encourage domestic production of lithium-ion cells for batteries used in electric vehicles (EVs), the customs duty on the import of capital goods and machinery used in the manufacturing of lithium-ion cells is now exempted.

In a boost to domestic electronics manufacturing, the 2.75% Basic Customs Duty on the import of camera lens and its inputs have been removed. Additionally, the Basic Customs Duty on parts of open cell assembly for TV panels have been slashed from 5.5% to 2.75%.

The customs duty exemption to raw materials for manufacture of CRGO Steel, ferrous scrap and nickel cathode shall be continued.

Retail and e-commerce

States will be encouraged to set up a Unity Mall in a prominent city for the promotion and sale of their own ODOPs (One District, One Product), Geographical Indication (GI) products and other handicraft products, and for providing space for similar products from other states.

Amendments are being made in section 10 and section 122 of the CGST Act to enable unregistered suppliers and composition taxpayers to make intra-state supply of goods through E-commerce Operators (ECOs).

Logistics and Infrastructure

In a massive push to the ongoing UDAN scheme, fifty additional airports, helicopters and water aerodromes and advanced landing grounds will be revived to improve air connectivity in the country.

All Indian states and cities will be encouraged to undertake urban planning reforms to build “Sustainable Cities for Tomorrow” that promote efficient use of land resources, adequate resources for urban infrastructure, transit-oriented development, enhanced availability and affordability of urban land, and opportunities for all.

The 50-year interest free loan to state governments will be extended by one year with an outlay of ₹1.3 lakh crore. The aim is to spur investment in infrastructure and incentivise complementary policy actions.

Sustainability

In terms of broad funding allocation, INR 10,000 crore go to the development of 500 new ‘waste to wealth’ (biogas) plants. Solar power’s allocation increased by 48% to Rs 7507.46 crore (with the majority of funding going to the PM-KUSUM scheme), while wind power saw its allocation slashed by 14% to Rs 1,214 crore.

For promotion of battery energy storage systems, batteries with a capacity of up to 4,000 MWH will be supported with Viability Gap Funding from the center. Pumped hydro storage will also see a new framework issued shortly. In addition, 5% compressed biogas mandate will be introduced for all organisations marketing natural and biogas.

To evacuate the vast amounts of renewable energy from the mega solar parks in various stages of development in Ladakh, the inter-state transmission system for evacuation and grid integration of 13 GW of renewable energy from the union territory will be constructed with investment of INR 20,700 crore (including central support of INR 8,300 crore).

Tracking the G20

In this week’s operational developments for the G20, the first employment working group meeting kicked off on 2nd February in Jodhpur. The deliberations here revolve around the themes of (1) addressing global skill gaps, (2) gig and platform economy and social protection, and (3) sustainable financing of social security. The international financial architecture working group also met in Chandigarh. Next week, the first meeting for the energy transition working group will take place in Bangalore. The focus areas for the working group are energy transition through addressing technology gaps, low-cost financing for energy transition, energy security and diversified supply chains, energy efficiency, industrial low carbon transitions and responsible consumption, Fuel For Future (3F) and universal access to clean energy and just, affordable and inclusive energy transition pathway.

Top Stories of the Week

India notifies Pakistan about amending the 1960 Indus Water Treaty

India announced on 27 January that it wishes to modify the Indus Waters Treaty (IWT) of 1960 with Pakistan, citing the neighbour’s “intransigence” in resolving past disputes relating to hydropower projects in J&K. The proposed modifications that India is considering are not yet known publicly. As per procedure under the treaty, Pakistan is required to respond to India’s notice within 90 days.

Pakistan, meanwhile, has approached the Permanent Court of Arbitration (PCA) at The Hague against the Kishenganga and Ratle hydroelectric power projects. India has chosen to boycott the proceedings, and has said that Pakistan’s move at the PCA was a “parallel process”, contrary to the “graded mechanism” of dispute resolution under Article IX of the IWT. Pakistan, on the other hand, has said that PCA Court was set up “under the relevant provisions” of the treaty.

Article IX of the IWT, titled “Settlement of Differences and Disputes”, provides for three possible steps to address disputes raised by either of the States: (a) co-operation between Indian and Pakistanis delegations of water experts at the Permanent Indus Commission; (b) consultations with a neutral expert appointed by the World Bank (also a party to the treaty); and (c) reference to the PCA through the World Bank. India is of the opinion that each of these steps must be fully exhausted before parties agree to proceed to the next step, which Pakistan has allegedly violated by moving the PCA unilaterally.

The IWT, which has survived decades of the worst periods of conflict between India and Pakistan and is hailed internationally as an example of peaceful conflict resolution between two hostile neighbours, will be modified for the first time in its history if India has its way in the matter.

India-US meet to discuss the initiative on Critical and Emerging Technology (iCET)

In May 2022, Prime Minister, Narendra Modi and US President, Joe Biden discussed the prospect of strengthening strategic ties between the two nations on the sidelines of the Quad meeting in Tokyo. Taking a step in that direction, National Security Advisors, Ajit Doval and Jake Sullivan met in Washington DC this Wednesday for the first meeting of the US-India initiative on Critical and Emerging Technology (iCET). Mutually agreed upon areas of cooperation cover defence, artificial intelligence, quantum technologies, high performance computing, co-production of jet engines, semiconductor supply chain, human spaceflight, commercial space launches and telecom, including 6G. While overall cooperation will remain an ongoing effort, the semiconductor ecosystem saw a concrete development through discussions during the meeting. The US Semiconductor Industry Association (SIA) and India Electronics and Semiconductor Association (IESA) plan to boost public-private collaboration in the chip ecosystem by forming a private-sector task force. The task force will develop a "readiness assessment" regarding the semiconductor ecosystem in India and gather industry, government, and academic stakeholders to identify near-term industry opportunities and facilitate longer-term strategic development of complementary semiconductor ecosystems.

Upcoming Events

Budget 2023 Related Events

3-8 February | Various

Union Budget 2023 Insights for India-US Business

FICCI in partnership with Embassy of India, Washington-DC, USA is organising a virtual session on Post Union Budget 2023 “Insights for India-US Business” on 8th February 2023 between 8:00pm - 9:00 pm. The session will present a closer look at the different components of the Union Budget to help understand businesses, specific to India-US with focus on economic outlook. More Information | Registration Link

Post Budget Conference - Analysis of tax related proposals and the way forward

ASSOCHAM is organizing a post budget conference to provide clear and comprehensive analysis of the direct & indirect tax related proposals of the Union Budget on 3rd February, 2023 at Hotel Shangri La, New Delhi. More Information | Registration Link

The 17th 5-Institute Budget Seminar 2023

The heads of the five Institutes, the Centre for Policy Research (CPR), the Indian Council for Research on International Economic Relations (ICRIER), the India Development Foundation (IDF), the National Council of Applied Economic Research (NCAER), and the National Institute of Public Finance and Policy (NIPFP), will come together to discuss and present a reform and development perspective on the 2023-24 Union Budget on 6th February, 2023 at the NCAER, T2 Auditorium, New Delhi. More Information | Registration Link

India Energy Week

6-8 February | Bangalore International Exhibition Centre

The Ministry of Petroleum and Natural Gas is hosting India Energy Week on 6-8th February at the Bangalore International Exhibition Centre. A part of India’s G20 presidency events, this is expected to be India’s largest energy related exhibition. Over 30,000 visitors are expected with over 650 companies exhibiting at the energy week. More Information | Registration Link

A Few Good Reads

In a thorough deep dive, Jai and Veeru spell out the obstacles that hinder the deepening of our power markets, and explore what we can do to create a more pro-market ecosystem.

At the 75th anniversary of his passing, Ramchandra Guha writes a provocative piece on the disputed legacy of Mahatma Gandhi.

Should new tokens earned through staking be taxed? No, argues Abraham Sutherland.

Can declining inflation bounce back up? Some thoughts on the weird trajectories inflation can take, by Tyler Cowen.

C Raja Mohan looks at how the Sino-Russian alliance has complicated India’s foreign policy calculus, one year on.

Tweets of the Week

A tweet for the budget season! Check out how much we budgeted across heads in independent India’s first ever budget:

Milan Vaishnav looks at what the “Big Mac” index says about the Rupee:

Prime Minister Modi shares visuals from the ‘beating the retreat’ ceremony:

Key Notifications

TRAI presents highlights of telecom subscription data in India and releases a consultation paper on regulating converged digital technologies and services – enabling convergence of carriage of broadcasting and telecommunication services

Department of Revenue notifies changes in the customs duties for various products.