The Aakhya Weekly #47 | A Tale of Precarity and Invisibility

In Focus: Social Security in the Informal Sector - India’s Legacy Problem

Carrying the remnants of their lives in makeshift bundles on their backs, tens of thousands of daily wage workers started walking hundreds of kilometers to their native villages on March 24th, 2020. The air was thick with uncertainty, exhaustion, and fear, but what resonated most was the anguish over lost livelihoods. India, home to approximately 380 million informal workers, was abruptly awakened to the vulnerability of its informal sector as the nation plunged into a complete lockdown due to the Covid 19 pandemic.

India's labor market is characterized by the predominance of informal employment, with over 90% of the workforce engaged in unorganized, self-employed, and casual work. While informal employment offers flexibility, autonomy, and accessibility, it also exposes workers to economic shocks, natural disasters, and income insecurity. Furthermore, informal workers face a lack of healthcare support, limited growth opportunities, and other benefits. Despite the global consensus on extending social security to the informal workforce, the monumental task becomes even more challenging due to the absence of accurate data and the heterogeneous nature of India's massive informal economy.

Recognizing existing legislation as complex, archaic, and inconsistent, the Ministry of Labour and Employment introduced four bills in 2019 to consolidate 29 central labor laws, including the Code on Social Security 2020. This legislation tackled one of the significant barriers to social security implementation in India's informal sector - the absence of formal worker identification. To address this, the government established the 'e-Shram portal,' aiming to create a comprehensive database of unorganized workers in the country, seeded with Aadhar data. The portal serves as the platform through which all registered workers gain access to personal accident insurance, term insurance, pension schemes, health insurance, financial inclusion schemes, job guarantee programs, and more. Within a year of its launch, the portal garnered approximately 280 million registrations, encompassing nearly 75% of India's workforce. Moreover, the Code expanded social security coverage to inter-state migrant workers, construction workers, film industry workers, and platform workers, progressing towards a more inclusive approach.

Nevertheless, several factors still

impede the uniform disbursal of social security benefits in the informal sector, creating a legacy problem for India.

Defects in the government machinery

Efficient administrative mechanisms and robust implementation processes are essential to extend social security to the informal workforce. However, India struggles with the implementation of laws, particularly related to welfare schemes. Challenges arise from reaching the vast and diverse informal workforce, maintaining accurate records, ensuring compliance, and preventing fraud. As a concurrent subject, labour comes under the purview of both the central and state governments. The Code on Social Security retains a fragmented setup for the delivery of social security benefits including (i) a Central Board of Trustees, (ii) an Employees State Insurance Corporation, (iii) national and state-level Social Security Boards, and (iv) cess-based labour welfare boards for construction workers. If the abysmal implementation of the Prevention of Sexual Harassment (POSH) Act teaches us anything, it is that this exposes the implementation process to bureaucratic delays, lack of accountability and other long-standing systemic leakages, rendering the scheme inefficient.

The question of compliance burden

Unlike developed countries, the Indian economy cannot solely rely on government budgets to bear the financial burden of social security benefits. Limited fiscal capacity, a small formal workforce, and competing priorities pose challenges to the long-term financial sustainability of social security programs. Informal sector employers, mainly individuals or small enterprises, often lack the financial resources to contribute to social security funds. While the requirement aims to benefit workers, it may inadvertently lead to the proliferation of illegal arrangements as employers seek to avoid compliance. When neither the government nor the employers can fund social security schemes, on whom does the burden then fall?

Gendered exploitation

Women constitute a majority of the informal workforce, and gender-sensitive policy-making is crucial in addressing the sector. Many women occupy underpaid positions without formal contracts, often working under middle-men. Mapping out methods of disbursal in such a scenario is a Herculean task. An additional challenge is to overcome the grave awareness deficit associated with government schemes that plagues women in the unorganised sector. Since employers in the sector often lack the means to fund long-term benefits such as maternity support, the requirement to provide additional benefits exclusively for female workers could disincentivize their hiring in better roles.

Recognizing the importance of social security for informal workers and the potential for inclusive economic growth, concerted efforts must continue to bridge the gap and provide meaningful social protection to this vast segment of the workforce. The problem of social security in the informal sector is certainly marred by intense complexity in India. Addressing it requires a multi-faceted approach that involves more policy reforms, improved formalization processes, targeted financial inclusion initiatives, and innovative funding mechanisms, all while ensuring viability. The legacy of this problem may pass down to another generation, but such is the sad tale of precarity and invisibility.

Top Stories of the Week

India-Russia Rupee settlement falters

A Reuters report, last week, claimed that India and Russia have suspended their efforts to settle bilateral trade in Rupees. While Russia and India have both denied the veracity of the report, the event highlights severe teething difficulties in the internationalisation of the Rupee.

Currently, India-Russia trade is beset with procedural difficulties. With heavy US-led sanctions against the latter, settling such trades is tricky. India currently relies on third parties - including China - to facilitate such transactions. The Rupee is also not freely convertible, and there is hence no market price for direct Rupee-Rouble trade. Two currency conversions are therefore required every time a payment is made - one, from the Rupee to the US Dollar, and then, from the US Dollar to Roubles.

In view of these issues, India has mooted a permanent trade mechanism between the two countries, with international trade in the Rupee. However, it has made little progress on this front. Most India-Russia trade continues in Dollars, with an increasing number in currencies like the UAE’s Dhiram. Rupees are simply inconvenient for bilateral trade.

Critically, Russia has little use for Rupee trade. Ever since India took to importing vast quantities of Russian crude oil at discounted rates, its imports from Russia dwarf its exports completely ($46.5 billion against $3.2 billion, for FY 2022-23). Should bilateral trade be denominated in Rupees, Russia fears that it shall end up with an excess of Rupees worth $40 billion dollars each year. India has a minimal share in global exports as well. Russian Foreign Minister Sergei Lavrov recently commented on how the country has accumulated billions of Rupees. While some of this finds its way into Indian sovereign bonds, by and large, Russia has very little that it can do with its Rupees.

Former Pak PM Imran Khan arrested; released following widespread violence

In geopolitics, an unstable neighbourhood is never a good thing – especially when that neighbour has access to nuclear weapons. Nothing better exemplifies this than the arrest of Pakistan's former Prime Minister Imran Khan, who was picked up on 9 May by paramilitary forces under orders from the National Accountability Bureau (NAB). Indian security forces maintained their vigil along the Line of Control (LoC) and the International Border between both countries as mayhem unfolded in city after city, with videos of widespread looting and arson circulated on social media. Khan’s supporters took to the streets, destroying public property, clashing with law enforcement, and even destroying the residence of the Corps Commander in Lahore and the General Headquarters (GHQ) in Rawalpindi. On the evening of 11 May, the Supreme Court of Pakistan ordered his immediate release, declaring the arrest to be illegal and coming down heavily on the NAB for ordering it without seeking the court's permission. As of now, he remains under protection of security forces and will appear before the Islamabad High Court today.

Khan, a cricketing legend, is immensely popular in Pakistan. His ouster from power by the Pakistani military in April 2022 led to widespread public dissatisfaction and turmoil in the markets. His arrest was likely the tipping point, at a time when Pakistan is already reeling under an economic crisis. The Pakistani rupee, which had already depreciated by 50% in the past year, fell by 3.3% to a record low of 300 per dollar as the military stepped in to quash the violent protests. The government is currently negotiating a $6.5 bn bailout package with the IMF, which it desperately needs to avoid a default. Indian forces remain alert to possible movements by the Pakistan Army along the LoC as a diversion tactic.

The dramatic manner of Khan’s arrest by the Pakistan Army from court premises is reminiscent of the widely publicised arrest of Supreme Court Judge Iftikhar Chaudhry back in 2007 by the Musharraf regime, which also led to widespread protests (then led by Pakistan’s lawyers) demanding the judge’s release. While that incident occurred under vastly different circumstances from present-day events, it is still a worthy reminder of how the Pakistan army's disregard of the rule of law has remained unchanged with the passing years.

This Week in Policy

Economy and Taxation

RBI’s gold reserves, as at the end of March 2023, have increased by 34.22 tons year-on-year to reach 794.64 tons. Gold holdings comprise a key portion of a country’s foreign reserves.

Sustainability and Energy

Kerala State Electricity Board proposes a ‘green energy tariff’ of ₹2.54 a unit to compensate for for procurement, banking (storage), and round-the-clock supply of green energy.

The government is planning to divert the unitilised ₹ 3,000 crores earmarked for electric three wheelers under the FAME II scheme towards subsidising an additional 3,000 electric buses.

Emerging Technology and Media

The Lok Sabha Secretariat is looking to launch 'Digital Sansad', a first-of-its-kind digital platform that will provide access to parliamentary records and use AI-based technology for real-time transcription of Parliamentary proceedings in all 22 scheduled languages.

The Government of India plans to reopen the application process for US$10 bn in incentives and assistance to encourage chip manufacturing in India, with an open-ended process and removal of the 45-day requirement to submit applications.

International Trade and Foreign Affairs

PM Modi met with Israeli Foreign Minister Eli Cohen and discussed ways to deepen bilateral ties in key priority areas such as agriculture, water, innovation and people-to-people relations. FM Cohen has expressed a “strong desire” to finalise a free trade agreement with India due to the high scope of bilateral trade between both countries.

India is one of the first seven countries to benefit from Saudi Arabia's new e-visa system, aimed at digitising consular services and replacing the traditional visa stickers on passports.

India and 80 other countries are pushing for text-based negotiations at the World Trade Organisation to find a permanent solution on public stockholding for food security.

Healthcare

The WHO has formally declared that COVID-19 is no longer a global public health emergency. The organisation’s fourth plan on fighting the disease, too, focuses on transitioning from an emergency response to long-term management of the disease.

Assam launches the ‘Ayushman Asom Mukhya - Mantri Jan Arogya Yojana,’ a cash-less healthcare scheme offering medical treatment of up to INR 5 lakh per family per year.

Banking, Finance and Insurance

SEBI allows stock exchanges to extend direct market access facility to foreign portfolio investors (FPIs) for participation in Exchange Traded Commodity Derivatives (ETCDs), thereby allowing clients of a broker to directly access the exchange trading system through the broker's infrastructure to place orders without manual intervention by the broker.

SEBI levied fines totaling Rs 35 lakh on seven entities for indulging in non-genuine trades in the illiquid stock options segment on BSE. The entities observed a large-scale reversal of trades in the illiquid stock options segment of the BSE, leading to the creation of artificial volumes on the bourse.

RBI has asked banks to revise their new locker agreements with clients to specify that the lockers can be used only for purposes such as storing jewelry & documents and not for storing any cash or currency, arms, weapons, drugs, contraband, or hazardous substances.

Retail, E-commerce and FMCG

Incentives for subsidising delivery cost for buyers will now be capped on ONDC, reducing the glaring price difference from its competitor platforms. The order came into effect on May 9th 2023.

India’s packaged goods sector recovered with double-digit value growth of 10.2% in the January-March 2023 quarter, faster than the previous quarter when the sector grew at 7.6%.

Logistics and Infrastructure

The Ministry of Road Transport and Highways is in talks industry players on development of economically viable electric highways in the country.

Owing to the National Highway Authority of India’s increasing debt servicing burden, contingent liabilities, dependence on government budgetary support and ambitious highway and infrastructure plan, NITI Aayog has ordered an evaluation of the former’s work.

In a key reform, airport, seaport, railway and metro rail builders can now join in the task of building highways under a new government order aimed at giving a boost to dwindling road construction. So far, only specialist and experienced road builders have been allowed to participate in such bids.

Labour

India’s unemployment rate rose to a four-month high of 8.11% in April, growing from 7.8% in March, as per CMIE data. Notably, however, this figure reflects an increase in the labour force participation rate from 39.77% to 41.98% - an increase of 25.5 million people.

Tracking the G20

This week in India’s G20 presidency witnessed a unique development - the formation of an official creditor committee, co- chaired by India, Japan and France, to discuss the Sri Lankan authorities’ request for a debt treatment, formally announced by the President of Sri Lanka in March of this year. The members of the creditor committee are representatives of countries with eligible claims on Sri Lanka. Paris Club members with no eligible claims, as well as China, Saudi Arabia and Iran attended the meeting as observers, along with representatives from the IMF and World Bank. The group will aim to find an appropriate solution to Sri Lanka’s external debt vulnerabilities, consistent with the parameters of the IMF program announced late last month.

In other G20 news, the 3rd meeting of the Development Working Group took place in Goa. The discussions at this meet are expected to feed into the Development Ministerial Meeting in June, including deliberating on a G20 action plan to accelerate progress on the Sustainable Development Goals.

Upcoming Events

5th meeting of Taskforce 3.0 on Blue Economy

May 22 | FICCI, Federation House, New Delhi

FICCI is organizing its 5th meeting of Taskforce 3.0 on the Blue Economy on May 22, 2023. The objective of the meeting is to discuss the established Taskforce 3.0 on the Blue Economy to complement the Government of India’s vision for the industry. More Information

A Few Good Reads

Bibek Debroy, Amey Sapre and Aditya Sinha lay out the argument for moving to the 2011-12 GDP series and detail the changes that the shift entailed.

Pakistan is facing a multi-system meltdown, and Imran Khan’s arrest will only exacerbate the situation, writes Mohammad Taqi.

Why has international trade in the Rupee stumbled, and what lessons does this hold for globalisation? Vivek Kaul explores.

The Manipur crisis is yet another symptom of our inability to come up with objective criteria for who makes for a ‘scheduled tribe,’ argues Sanjib Baruah.

Why does ONDC seem to be so much cheaper than Zomato or Swiggy? Tushar Goenka and Deepsekhar Choudhury take a look.

Tweets of the Week

Shashank Mattoo details India’s plan to link the Middle-East, building its own reputation in the process:

A moonshot idea to fix climate change and make money in the process, via Tomas Pueyo:

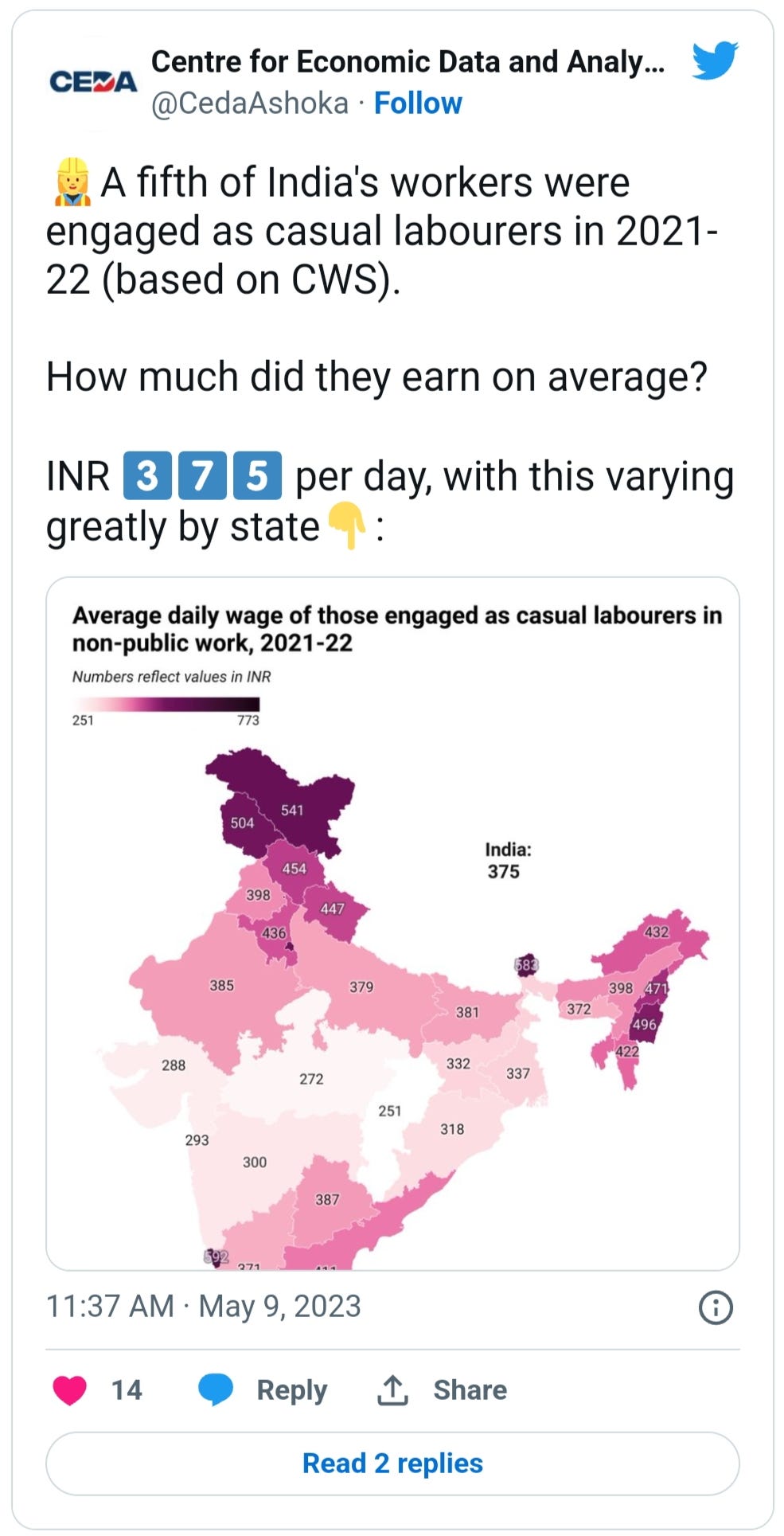

CEDA looks at how much India’s casual workers earn:

Key Notifications and Reports

Telangana has launched a one-of-its-kind ‘State Robotics Framework’.

RBI has made it easier for informal MSMEs in accessing priority sector lending, by treating an ‘Udyam Assist Certificate’ as equivalent to an ‘Udyam Registration Certificate’.

The RBI has released its annual Report on Currency and Finance 2022-23. This year’s edition covers the macroeconomic impacts of climate change in the country, and discusses the financial and policy tools at India’s disposal to tackle the same.